Some of the weak links in disrupting money laundering and its associated risks include a lack of knowledge of the vulnerabilities of financial institutions, a lack of preventive measures put in place, and a lack of trust among stakeholders and governments.

‘Disrupting criminal trafficking and smuggling networks through increased anti-money laundering and financial investigation capacity in the Greater Horn of Africa’

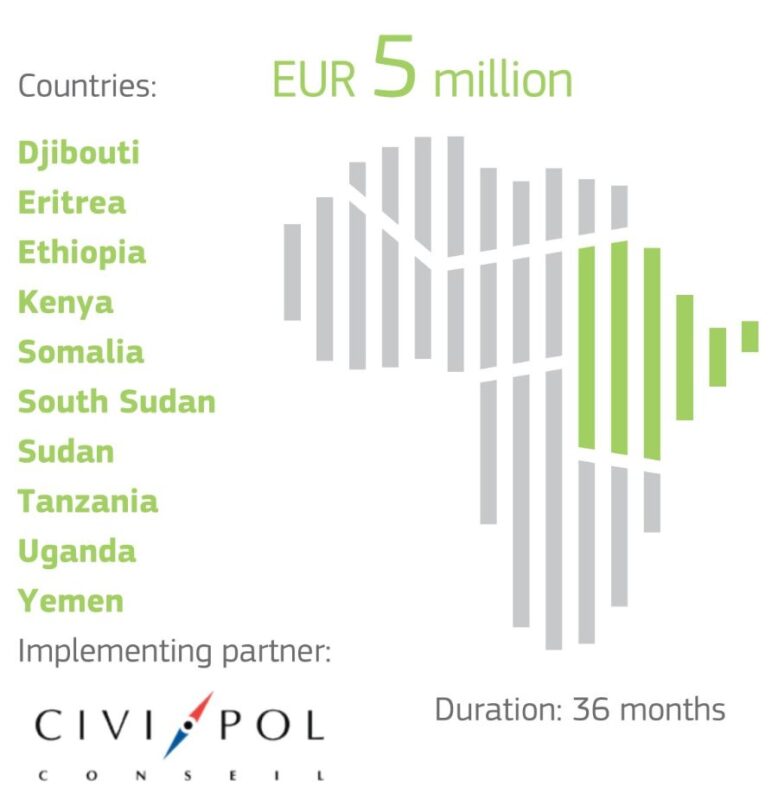

(AML/THB) is a regional programme, funded by the European Union’s Emergency Trust Fund for Africa (EUTF). The aim of this programme is to improve the coordination and investigation methods used against cross-border criminal organisations that profit from irregular migration, human trafficking and other types of organised crime, with an aim to disrupt these criminal activities.

The main beneficiaries of this programme are financial intelligence units, law enforcement and border management agencies, judicial authorities, as well as financial institutions of participating countries.

The programme will support the development of national and regional anti-money laundering techniques, including tracing and seizing assets and criminal proceeds, crime investigation and prosecution. This will be done by supporting the analytical and operational capacity in financial investigation and anti-money laundering techniques of national and regional bodies and increased coordination and collaboration between national services and countries in the region.